We have updated our 2014 survey with transaction data over the past several years from private company sellers, those that provided feedback after their deal was done, to gain insight into what was important to them and to better understand the selling process through their eyes. While we are located in the Research Triangle Park area of North Carolina, we leveraged our national network of contacts to gain broad perspective in a variety of industries and states. Below are a few statistics that might help you as you think about selling your company (or helping your client in the process):

Number of survey participants: 92

Years in which their companies were sold: 2010 – 2018

Industries represented: 20

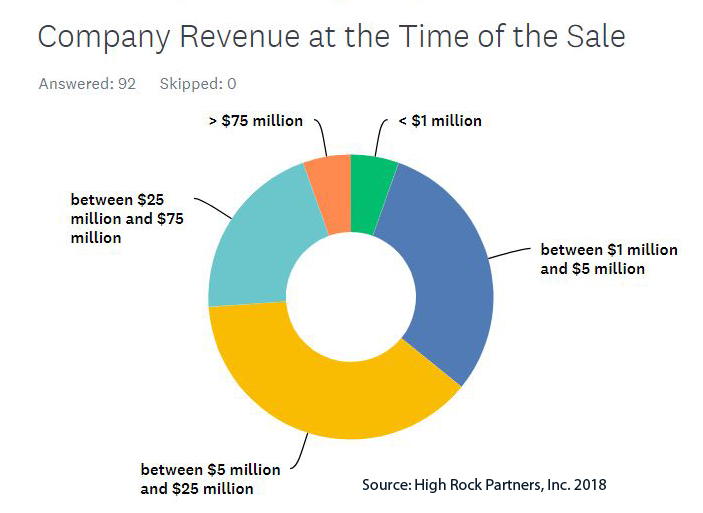

As you can see from the chart below, companies representing the lower-middle and middle market participated, with revenues ranging from a few million dollars to nearly $250 million.

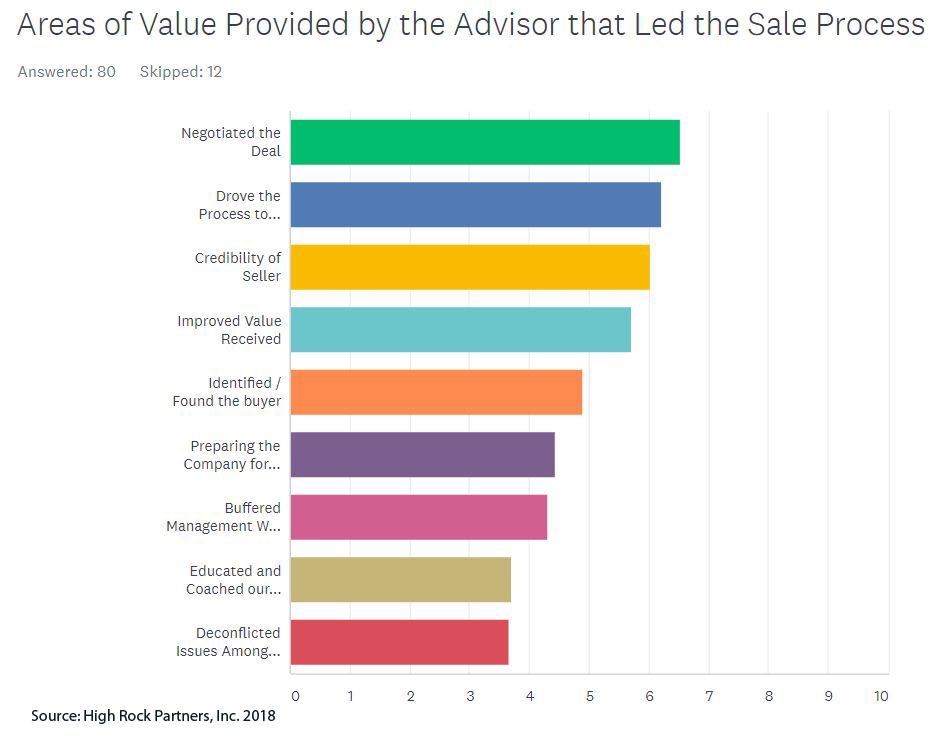

So where did the advisors add value? That’s the chart below, ranking the area of value-add by highest or most value to lessor. As you can see, the highest ranked areas were about the credibility attributed to the seller based on the advisor’s credibility coupled with leading the process and having an understanding of the transaction to negotiate on the seller’s behalf. On a combined basis, these should enable the seller to achieve value that they might not otherwise have realized on their own. Contrasting the value of legal counsel in the negotiating process, a M&A advisor should be able to assist in structuring the economic elements of the transaction to optimize the deal for you. Surprising to many sellers is that “finding or identifying the buyer” is not on the top of the list. It is important, and there should be solid process for understanding the logical buyer groups and who the key players are in each; however, actually contacting and get to the buyers is much easier in today’s environment than you might expect. What is not so easy, is getting through their filter as a viable acquisition target ….in our view, this is why credibility of the seller ranked higher.

Two additional areas of value add are worth noting. First, preparation for the sale process is so critical and relates directly to credibility. A key concept above all is elimination of surprises to the buyer. Surprises Kill Deals! It is better to spend the time, understand the issues and opportunities specific to your company, and proactively prepare and address them at the right time in the process. The second and last area of value add in this post deals with communication and negotiations. Private equity and strategics are the two main groups of buyers. In both cases, management needs to preserve and build their relationship with the buyer as the process gains traction. Invariably there will be tough issues to be communicated and tackled. The M&A advisor should be able to run interference for management on the difficult and contentious issues, allowing the seller to preserve their goodwill in the relationship. Having a third party push on these deal points also gives the seller a fallback if the advisor pushes too hard. After all, you can always fire the deal team …you can’t fire yourself as the seller. So what you say is hard to retract.

I realize that this is self-serving, but we found in the comments, consistent feedback from experienced sellers indicating that they use a third part to facilitate their transactions.