Corporate Finance

Financing Growth, Acquisitions, Turnarounds & Special Situations

ow are you going to fund your next wave of growth? Should you use debt or equity …and if so, how much of each and who do you get it from, how much and when? Or maybe the bank has called your loan because your company is navigating a rough patch, or they won’t lend as much as you need?

The types and sources of financing are usually stage dependent, and based on the eight basic factors that influence capital structure. Planning for the capital needs of your company usually gives you increased odds of getting the capital you want at competitive costs before you need it.

We lead the process and help management determine the viable financing options and better understand how to fund growth, working capital, turnarounds and acquisitions.

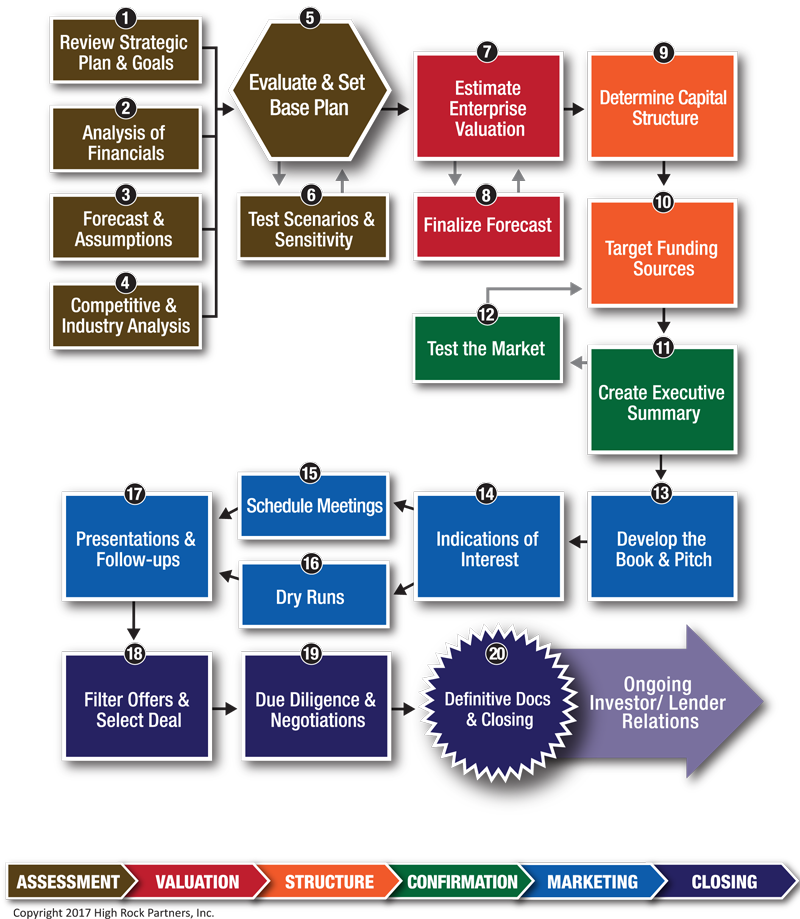

The Financing Accelerator™ is our proven service for developing and implementing funding alternatives. The section below titled “Approach” provides details. Much of the process is based on our practical experience and research as published in the Handbook of Financing Growth.

What We Do

We know about raising capital…we wrote the book (see the Handbook of Financing Growth). Our corporate finance practice focuses on the capital structure and financing of companies; including how it is financed and positioned to fund its growth. Shareholder value can many times be increased by properly capitalizing a company.

We will drive the process of evaluating financing alternatives and executing on the financing strategy using the Financing Accelerator™…developed through research and experience. It is important to determine the amount of capital and the form (debt vs. equity) required to fund the growth of a company. This capital structure is based on the company’s stage, industry, and growth rate coupled with the objectives of the shareholders and the state of the capital markets and economy.

Once the proper capital structure is determined, we drive the process of implementing the necessary changes. Among specific activities, this usually includes:

- Obtaining debt or equity

- Renegotiating or establishing lines of credit (credit advisory)

- Obtaining alternate sources of financing

- Restructure the balance sheet

In addition to overall capitalization projects, we advise on (and implement) specific initiatives such as company valuation, financing a management buyout, or financing specific asset acquisitions.

Our Approach

The graph below outlines the major steps in a comprehensive financing service …we call it the Financing Accelerator™. You can read about it in-depth in the Handbook of Financing Growth, written by our managing partner.