Acquisitions

Acquisitions & Integration

as your strategy or plan led you on the path of buying another company? Possibly a competitor or industry player has come on the market and you have the opportunity to acquire them? If so, are you clear on how to approach them, how to finance the deal and how to get it done without distracting your team and missing your numbers?

If done right, acquisitions can lead to incredible strategic leverage, new capabilities, access to new markets …and many other value-adding objectives. The key is pricing them correctly, mitigating the risks and executing a well thought-out integration plan.

Below we highlight some of the lessons learned, how we think about buying and integrating businesses, and links and resources that may help in building your business.

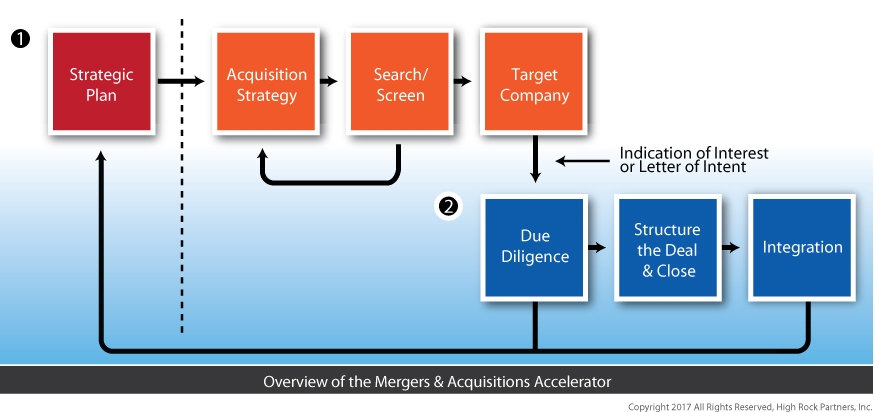

The Mergers & Acquisitions Accelerator® is our proven service for developing and implementing an acquisition plan. The section below titled “Approach” provides details.

What We Do

High Rock Partners is a true partner in developing and implementing an acquisition strategy. In fact, some of our clients think of us as their outsourced corporate development (or corporate finance) department …taking a holistic approach beginning with your overall corporate strategy and ending after the first 100 days of integration. The list below highlights some of the key areas of service that we provide in the context of acquiring and integrating businesses:

- Corporate strategy development

- M&A strategy & target identification (domestic and cross-border)

- Deal pipeline management

- Valuation & analytics

- Deal financing

- Lead negotiations

- Financial & strategic due diligence

- Integration planning

- Post-transaction integration

Our Approach

This graph illustrates the high-level steps involved in the acquisition process. In concept there are three major phases which we have simplified into two. The first involves having a well defined corporate strategy which might identify gaps or capabilities that may instigate an acquisition strategy. Second major phase involves the identification and deal process to actually purchase another business. The third phase is integration. Each of these is critical to the success of the overall process. High Rock is unique in its approach of leading strategy development (or confirmation) through – – the transaction with financing – – through the first 100 days of integration.